Think Big. Stream Bigger.

As a leading global streaming partner, we are an extension of your team, working alongside you to implement proven strategies to elevate your brand.

Streaming for sports media success

In the evolving media landscape, sports entities are embracing streaming as a valuable driver in their rights negotiations and growth strategies.

Case Study Oilers

The NHL’s Edmonton Oilers partnered with Endeavor Streaming to launch Oilers+, a dedicated OTT service to drive superfan engagement.

It’s Streaming, Streamlined

Our partners

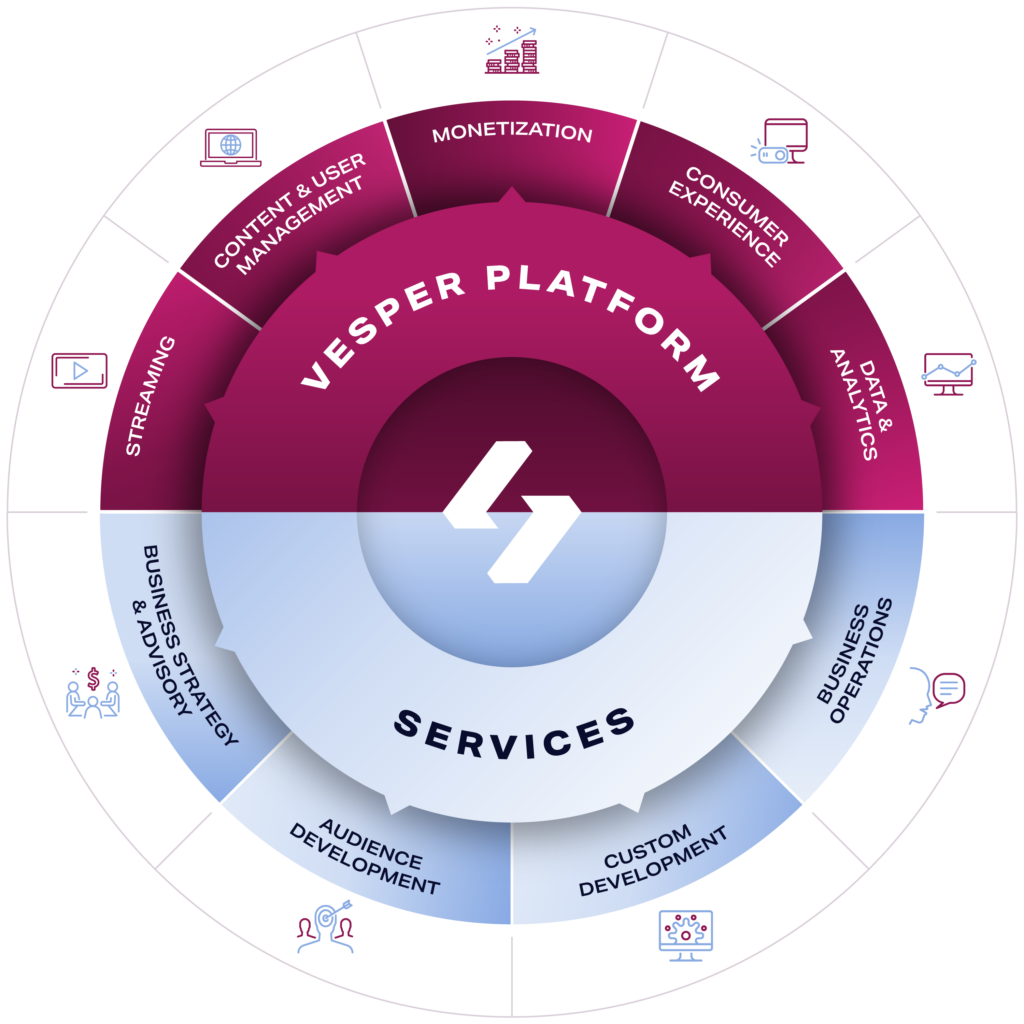

Your 360° Digital Transformation Partner

Navigate the evolving digital landscape with our comprehensive end-to-end streaming solutions. We fuse together cutting-edge technology with unmatched industry expertise, advisory and strategic services, partnering with our clients every step of the way to drive lasting impact and stronger business outcomes.

Stories That Captivate. Insights That Matter.

How ML Can Help Sports Streamers Prevent Churn

November 30, 2023

Read More

How to Craft a Stand-Out Streaming Destination in an Overcrowded Market

October 03, 2023

Read More

WORLD RUGBY AND ENDEAVOR STREAMING TEAM UP TO LAUNCH GLOBAL RUGBY OTT PLATFORM AHEAD OF THE RUGBY WORLD CUP 2023

August 25, 2023

Read More